This is the combination of trading account and trading profit and loss account to form a single document.

It ends when the net profit/loss brought down has been determined.

End Year Adjustments

The following items may require to be adjusted at the end of the trading period

- Revenues/Income

- Expenses

- Fixed assets

Adjustment on revenues

- The revenue may have been paid in advance in part or whole (prepaid revenue) or may be paid later after the trading period (accrued revenue).

- Prepaid revenue is subtracted from the revenue/income to be received and the difference is what is treated in the profit and loss account or trading profit and loss account as an income, while the accrued revenue is added to the revenue/income to be received and the sum is what is treated in the above accounts as the actual revenue.

- Only the prepaid amount and the accrued amounts are what are then taken to the balance sheet.

Adjustment on the expenses

- The expenses may have been paid for in advance in part or whole (prepaid expenses) or may be paid for later after the trading period (accrued expenses).

- Prepaid expenses is subtracted from the expenses to be paid for and the difference is what is treated in the profit and loss account or trading profit and loss account as an expense, while the accrued expenses is added to the expenses to be paid for and the sum is what is treated in the above accounts as the actual expenses.

NOTE:

Only the prepaid amount and the accrued amounts are what are then taken to the balance sheet.

Adjustment on fixed assets

- The fixed assets may decrease in value, due to tear and wear. This makes the value to go down over time, what is referred to as depreciation. The amount of depreciation is always estimated as a percentage of cost.

- The amount that shall have depreciated is treated in the profit and loss account or T,P&L as an expense, while the value of the asset is recorded in the balance sheet, less depreciation.

For example;

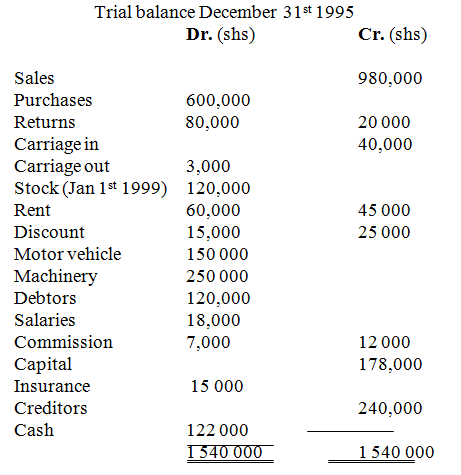

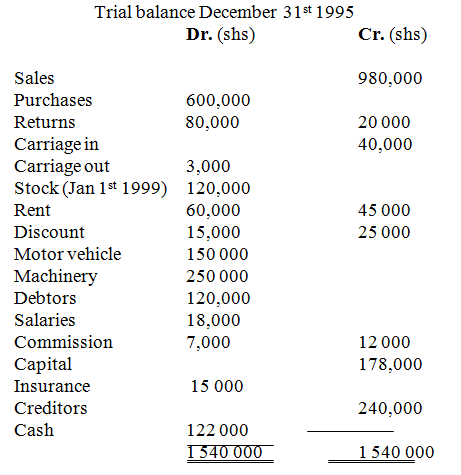

- 1997 The following Trial balance was prepared from the books of Paka Traders as at 31st December 1995.

Additional information

Stock as at 31st December was 100,000.

The provision for depreciation was 10% on the cost of Motor vehicle, and 5% on the cost of Machinery.

Required: Prepare trading profit and loss account for the period ending 31st December 1999.

Adjustments:

Provision for depreciation;

Machinery = 7 500

(New balance of machinery = 250 000 – 7 500 = 242 500. The 242 500 is taken to the balance as Machinery (fixed asset), while 7 500 is taken to the trading profit and loss account as expenses)

Motor vehicle = 15 000

(New balance of Motor Vehicle = 150 000 – 15 000 = 135 000. The 135 000 is taken to the balance as Motor Vehicle (fixed asset), while 15 000 is taken to the trading profit and loss account as expenses)

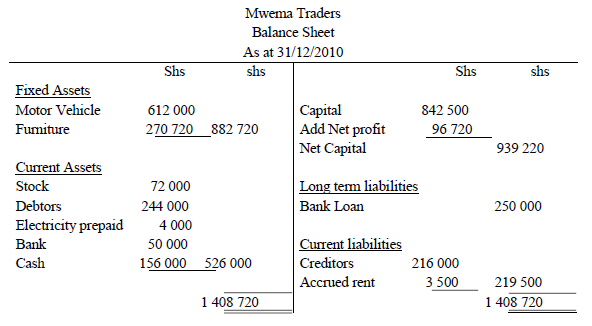

- The net profit/loss may be taken to the balance sheet.

- The items that have been adjusted will be recorded in the balance sheet less the adjustment.